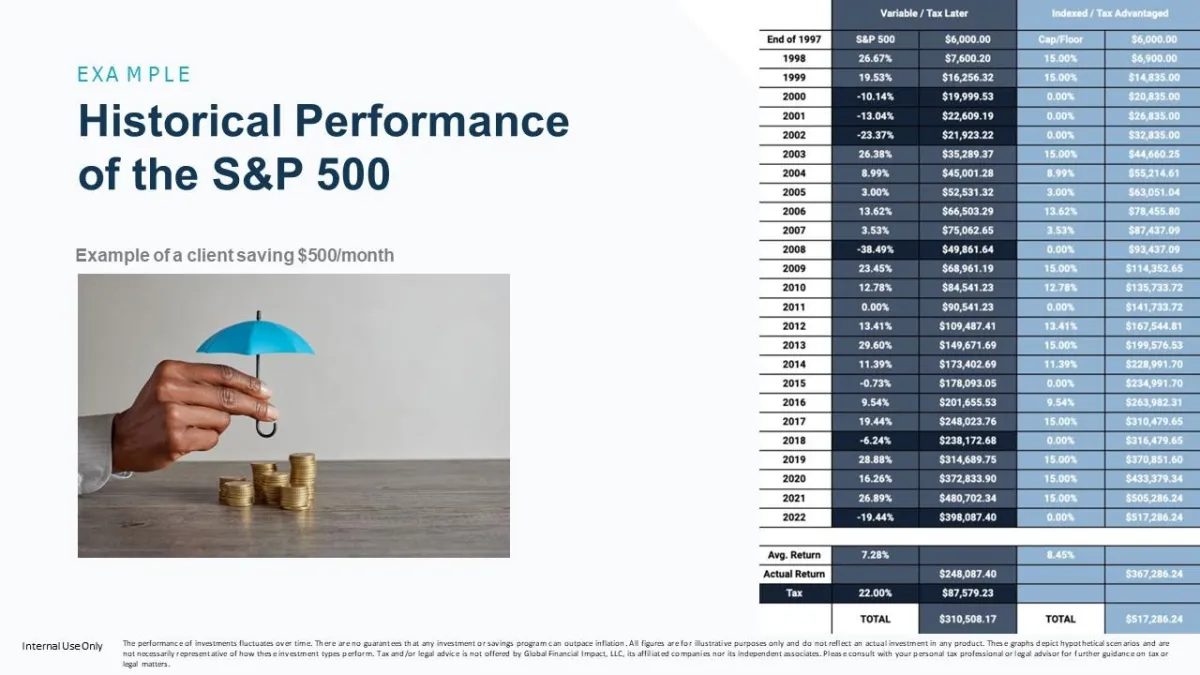

As you can see, during the years 2000, 2001, and 2002, the stock market experienced negative returns, resulting in significant losses for variable accounts such as 401(k)s and Roth IRAs. This impact is evident in the left columns, which show how these accounts were affected by market downturns.

Now, if you shift your focus to the columns on the right, you'll notice the performance of indexed accounts, such as Indexed Universal Life Insurance (IUL). While these accounts did not experience gains during those years, they also avoided any negative impact, effectively protecting the account’s value.

The same scenario repeated in 2008 and 2018, demonstrating how an IUL can be incredibly beneficial when properly structured. By utilizing its cash value as a retirement vehicle, you can safeguard your financial future against market volatility while still enjoying the potential for growth in stable years.